What Is 501 Tax Exempt Status . 501(c)(3) is just one category of 501(c) organizations, but it is the primary nonprofit status through which donations made to. a 501(c)(3) organization is a united states corporation, trust, unincorporated association or other type of organization exempt from. The irs recognizes more than 30 types of. the tax exempt organization search tool. You can check an organization's: Some strict rules apply to qualifying,. 4.5/5 (890) organizations that meet the requirements of section 501 (c) (3) are exempt from federal income tax.

from www.youtube.com

the tax exempt organization search tool. The irs recognizes more than 30 types of. 501(c)(3) is just one category of 501(c) organizations, but it is the primary nonprofit status through which donations made to. You can check an organization's: 4.5/5 (890) organizations that meet the requirements of section 501 (c) (3) are exempt from federal income tax. a 501(c)(3) organization is a united states corporation, trust, unincorporated association or other type of organization exempt from. Some strict rules apply to qualifying,.

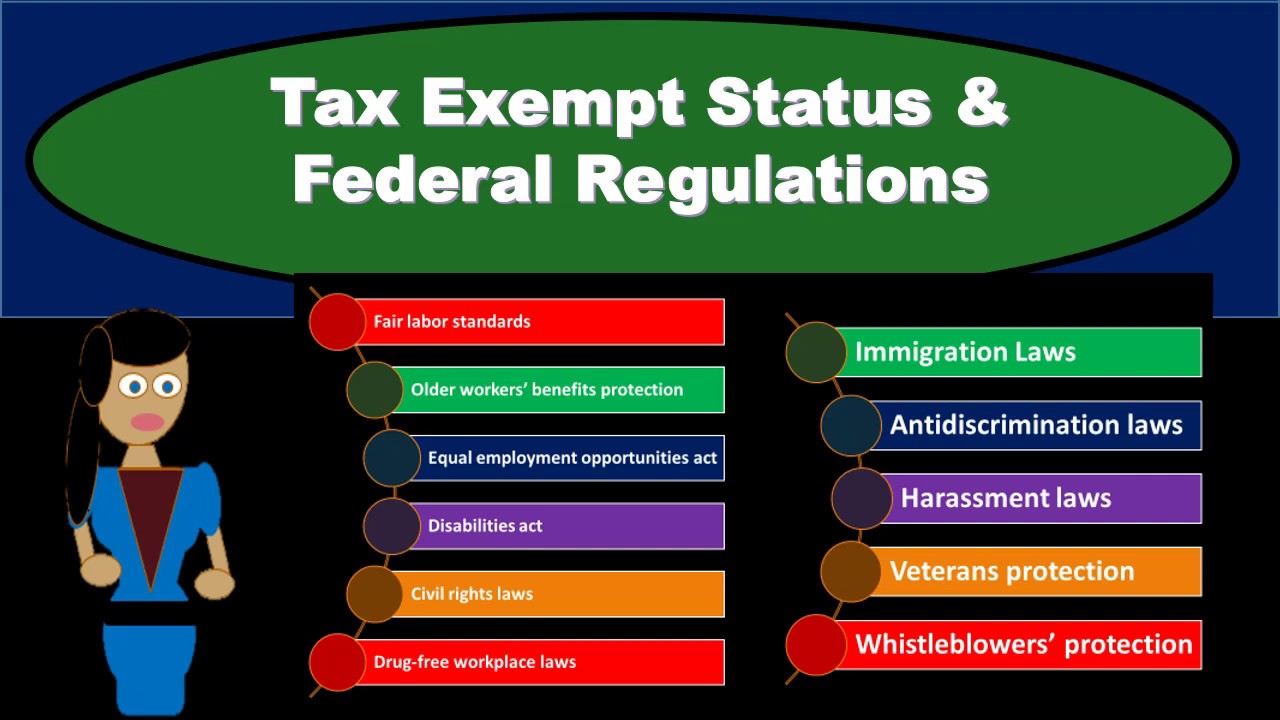

TaxExempt Status & Federal Regulations YouTube

What Is 501 Tax Exempt Status The irs recognizes more than 30 types of. You can check an organization's: the tax exempt organization search tool. organizations that meet the requirements of section 501 (c) (3) are exempt from federal income tax. a 501(c)(3) organization is a united states corporation, trust, unincorporated association or other type of organization exempt from. The irs recognizes more than 30 types of. 4.5/5 (890) Some strict rules apply to qualifying,. 501(c)(3) is just one category of 501(c) organizations, but it is the primary nonprofit status through which donations made to.

From slideplayer.com

IRS Tax Exempt Status AWSC Fall Oct ppt download What Is 501 Tax Exempt Status 501(c)(3) is just one category of 501(c) organizations, but it is the primary nonprofit status through which donations made to. the tax exempt organization search tool. a 501(c)(3) organization is a united states corporation, trust, unincorporated association or other type of organization exempt from. You can check an organization's: The irs recognizes more than 30 types of.. What Is 501 Tax Exempt Status.

From www.patriotsoftware.com

What Is 501(c)(3) Status? Taxexempt Status for Nonprofits What Is 501 Tax Exempt Status You can check an organization's: 501(c)(3) is just one category of 501(c) organizations, but it is the primary nonprofit status through which donations made to. the tax exempt organization search tool. The irs recognizes more than 30 types of. a 501(c)(3) organization is a united states corporation, trust, unincorporated association or other type of organization exempt from.. What Is 501 Tax Exempt Status.

From www.file990.org

Lost TaxExempt Status for Your 501(3)(c)? Get Reinstated File 990 What Is 501 Tax Exempt Status You can check an organization's: Some strict rules apply to qualifying,. 501(c)(3) is just one category of 501(c) organizations, but it is the primary nonprofit status through which donations made to. organizations that meet the requirements of section 501 (c) (3) are exempt from federal income tax. the tax exempt organization search tool. 4.5/5 (890) . What Is 501 Tax Exempt Status.

From www.gettrx.com

Non Profit 501 (c) (3) Status. Is Your Organization TaxExempt? What Is 501 Tax Exempt Status 501(c)(3) is just one category of 501(c) organizations, but it is the primary nonprofit status through which donations made to. 4.5/5 (890) You can check an organization's: organizations that meet the requirements of section 501 (c) (3) are exempt from federal income tax. Some strict rules apply to qualifying,. a 501(c)(3) organization is a united states. What Is 501 Tax Exempt Status.

From www.zrivo.com

Tax Exemption Requirements 501c3 Organizations What Is 501 Tax Exempt Status organizations that meet the requirements of section 501 (c) (3) are exempt from federal income tax. the tax exempt organization search tool. The irs recognizes more than 30 types of. 501(c)(3) is just one category of 501(c) organizations, but it is the primary nonprofit status through which donations made to. You can check an organization's: 4.5/5 . What Is 501 Tax Exempt Status.

From www.pdffiller.com

Fillable Online J Tax exempt status (check only one) 501(c)(3)15 What Is 501 Tax Exempt Status 501(c)(3) is just one category of 501(c) organizations, but it is the primary nonprofit status through which donations made to. 4.5/5 (890) You can check an organization's: a 501(c)(3) organization is a united states corporation, trust, unincorporated association or other type of organization exempt from. Some strict rules apply to qualifying,. the tax exempt organization search. What Is 501 Tax Exempt Status.

From slideplayer.com

IRS Tax Exempt Status AWSC Fall Oct ppt download What Is 501 Tax Exempt Status 4.5/5 (890) The irs recognizes more than 30 types of. the tax exempt organization search tool. Some strict rules apply to qualifying,. 501(c)(3) is just one category of 501(c) organizations, but it is the primary nonprofit status through which donations made to. a 501(c)(3) organization is a united states corporation, trust, unincorporated association or other type. What Is 501 Tax Exempt Status.

From www.yumpu.com

IRS 501(c)(3) taxexempt status determination letter IntraHealth What Is 501 Tax Exempt Status You can check an organization's: a 501(c)(3) organization is a united states corporation, trust, unincorporated association or other type of organization exempt from. 501(c)(3) is just one category of 501(c) organizations, but it is the primary nonprofit status through which donations made to. The irs recognizes more than 30 types of. organizations that meet the requirements of. What Is 501 Tax Exempt Status.

From www.cpapracticeadvisor.com

IRS Revises Application for Tax Exempt Status 501(c)(4) to Allow e What Is 501 Tax Exempt Status You can check an organization's: 501(c)(3) is just one category of 501(c) organizations, but it is the primary nonprofit status through which donations made to. a 501(c)(3) organization is a united states corporation, trust, unincorporated association or other type of organization exempt from. Some strict rules apply to qualifying,. 4.5/5 (890) organizations that meet the requirements. What Is 501 Tax Exempt Status.

From www.formsbirds.com

Applying for 501(c)(3) TaxExempt Status United States Free Download What Is 501 Tax Exempt Status a 501(c)(3) organization is a united states corporation, trust, unincorporated association or other type of organization exempt from. 4.5/5 (890) the tax exempt organization search tool. Some strict rules apply to qualifying,. You can check an organization's: organizations that meet the requirements of section 501 (c) (3) are exempt from federal income tax. The irs recognizes. What Is 501 Tax Exempt Status.

From www.uslegalforms.com

NC Certification of 501(c)(3) or Other TaxExempt Status 2011 Fill What Is 501 Tax Exempt Status 4.5/5 (890) the tax exempt organization search tool. The irs recognizes more than 30 types of. You can check an organization's: Some strict rules apply to qualifying,. 501(c)(3) is just one category of 501(c) organizations, but it is the primary nonprofit status through which donations made to. organizations that meet the requirements of section 501 (c). What Is 501 Tax Exempt Status.

From libertyfunddc.com

501(c)(3) Tax Exempt Organization National Liberty Memorial What Is 501 Tax Exempt Status Some strict rules apply to qualifying,. a 501(c)(3) organization is a united states corporation, trust, unincorporated association or other type of organization exempt from. 4.5/5 (890) The irs recognizes more than 30 types of. organizations that meet the requirements of section 501 (c) (3) are exempt from federal income tax. You can check an organization's: 501(c)(3). What Is 501 Tax Exempt Status.

From www.lawline.com

TaxExempt Status under Code Section 501(c)(3) Compliance and What Is 501 Tax Exempt Status You can check an organization's: The irs recognizes more than 30 types of. Some strict rules apply to qualifying,. a 501(c)(3) organization is a united states corporation, trust, unincorporated association or other type of organization exempt from. 501(c)(3) is just one category of 501(c) organizations, but it is the primary nonprofit status through which donations made to. . What Is 501 Tax Exempt Status.

From www.orionmilitary.org

Orion's 501(c)(3) Tax Exempt Determination Letter — Orion Military What Is 501 Tax Exempt Status 4.5/5 (890) organizations that meet the requirements of section 501 (c) (3) are exempt from federal income tax. The irs recognizes more than 30 types of. a 501(c)(3) organization is a united states corporation, trust, unincorporated association or other type of organization exempt from. Some strict rules apply to qualifying,. the tax exempt organization search tool.. What Is 501 Tax Exempt Status.

From www.youtube.com

TaxExempt Status & Federal Regulations YouTube What Is 501 Tax Exempt Status The irs recognizes more than 30 types of. 4.5/5 (890) 501(c)(3) is just one category of 501(c) organizations, but it is the primary nonprofit status through which donations made to. a 501(c)(3) organization is a united states corporation, trust, unincorporated association or other type of organization exempt from. the tax exempt organization search tool. Some strict. What Is 501 Tax Exempt Status.

From www.youtube.com

Part 5 501c3 Tax Exempt Status YouTube What Is 501 Tax Exempt Status The irs recognizes more than 30 types of. 4.5/5 (890) 501(c)(3) is just one category of 501(c) organizations, but it is the primary nonprofit status through which donations made to. You can check an organization's: Some strict rules apply to qualifying,. the tax exempt organization search tool. a 501(c)(3) organization is a united states corporation, trust,. What Is 501 Tax Exempt Status.

From www.501c3.org

Does a Church Need 501(c)(3) Status? A Guide to IRS Rules Foundation What Is 501 Tax Exempt Status the tax exempt organization search tool. 501(c)(3) is just one category of 501(c) organizations, but it is the primary nonprofit status through which donations made to. organizations that meet the requirements of section 501 (c) (3) are exempt from federal income tax. 4.5/5 (890) a 501(c)(3) organization is a united states corporation, trust, unincorporated association. What Is 501 Tax Exempt Status.

From www.wegnercpas.com

Maintaining your TaxExempt Status under IRS 501(c)(3) Wegner CPAs What Is 501 Tax Exempt Status 4.5/5 (890) organizations that meet the requirements of section 501 (c) (3) are exempt from federal income tax. The irs recognizes more than 30 types of. You can check an organization's: the tax exempt organization search tool. a 501(c)(3) organization is a united states corporation, trust, unincorporated association or other type of organization exempt from. . What Is 501 Tax Exempt Status.